Torbay Council are asking for your views on proposed changes to the Council Tax Reduction scheme from 1 April 2025.

Every year councils must decide whether to change the Council Tax Reduction Scheme for working age applicants in the area. The scheme for pension age applicants is set by government and is not affected by any of the options set out in this consultation.

Please note in this consultation we are also including some questions relating to national compensation schemes.

Council Tax Reduction is a discount for Council Tax. Currently the maximum discount is 75% for working age households and up to 100% for pension age households.

Councillor Alan Tyerman, Cabinet Member for Finance and Corporate Services, said: “We really want as many people in Torbay to have their say on these proposed changes to Council Tax Reduction as possible.

“This year, we have five proposals, one that will support the self-employed that have a disability or caring responsibility and not receiving Universal Credit, and four that will support households that may receive or have received certain compensation payments from the UK Government.”

There are five proposed changes in the consultation that your views are needed, which are:

- More targeted support for the self-employed, that are not receiving Universal Credit and have a disability (in the work group or support group of Employment and Support Allowance) or caring responsibility (caring for a person with severe disabilities). The proposal is to base the Council Tax Reduction on the actual income received.

- Disregarding, or not counting, any compensation payments made by the Post Office in connection with the failings of the Horizon system, when calculating Council Tax Reduction for working age households. This change has already been made by Central Government for the pension age Council Tax Support scheme and we wish to align this for working age customers as well.

- Disregarding, or not counting, any additional settlement payments resulting from the ongoing Grenfell Tower related civil litigation, when calculating Council Tax Reduction for working age households. This change has already been made by Central Government for the pension age Council Tax Support scheme and we wish to align this for working age customers as well.

- Disregarding, or not counting, any payments for the Vaccine Damage Payment Scheme, when calculating Council Tax Reduction for working age households. This change has already been made by Central Government for the pension age Council Tax Support scheme and we wish to align this for working age customers as well.

- Disregarding, or not counting, payments for Victims of Terrorist Attacks Abroad, when calculating Council Tax Reduction for working age households. This change has already been made by Central Government for the pension age Council Tax Support scheme and we wish to align this for working age customers as well.

You will find more detail on each of the proposals in the survey itself.

The consultation closes on 7 November 2024 at 11.59pm. If you have any questions or comments in relation to the consultation you can also email engagement@torbay.gov.uk

Voting now open to celebrate Torbay and South Devon NHS Foundation Trust’s brilliant people

Voting now open to celebrate Torbay and South Devon NHS Foundation Trust’s brilliant people

Find out about Fostering at one of Torbay’s events

Find out about Fostering at one of Torbay’s events

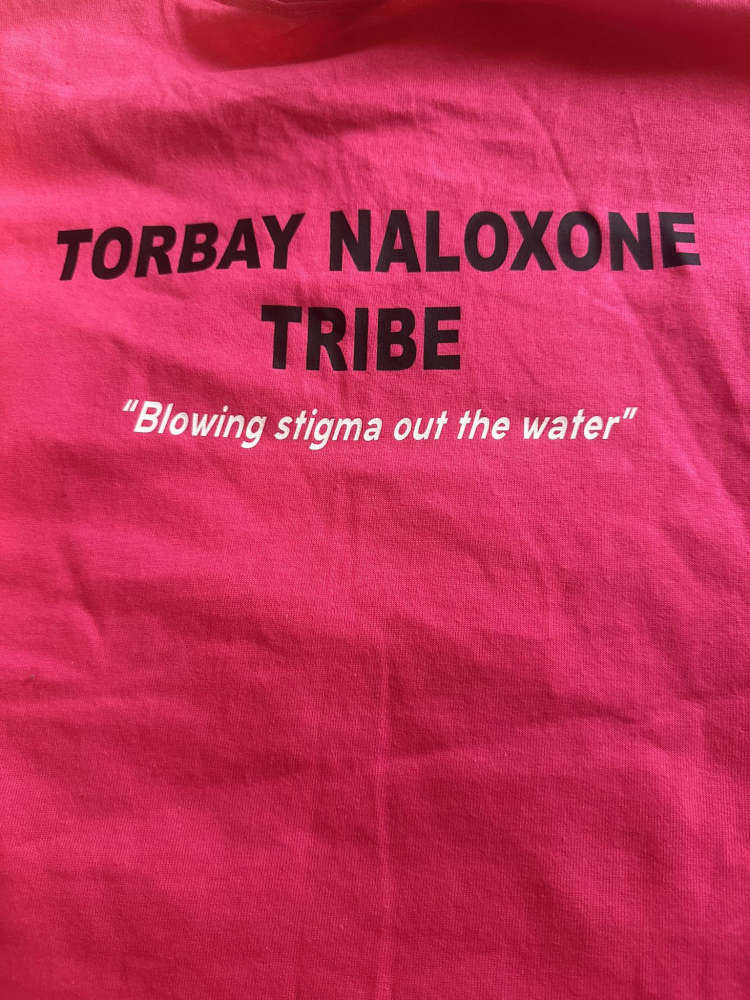

Members of the public urged to help prevent drug overdoses

Members of the public urged to help prevent drug overdoses

Community millions are ‘just sitting in the bank’

Community millions are ‘just sitting in the bank’